Here are our products

Fair Insight is a platform for individual investors, wholesalers and financial advisors to visually compare investments, select investments, build model portfolios, align portfolio & client risk, and optimize client performance among various portfolio alternatives.

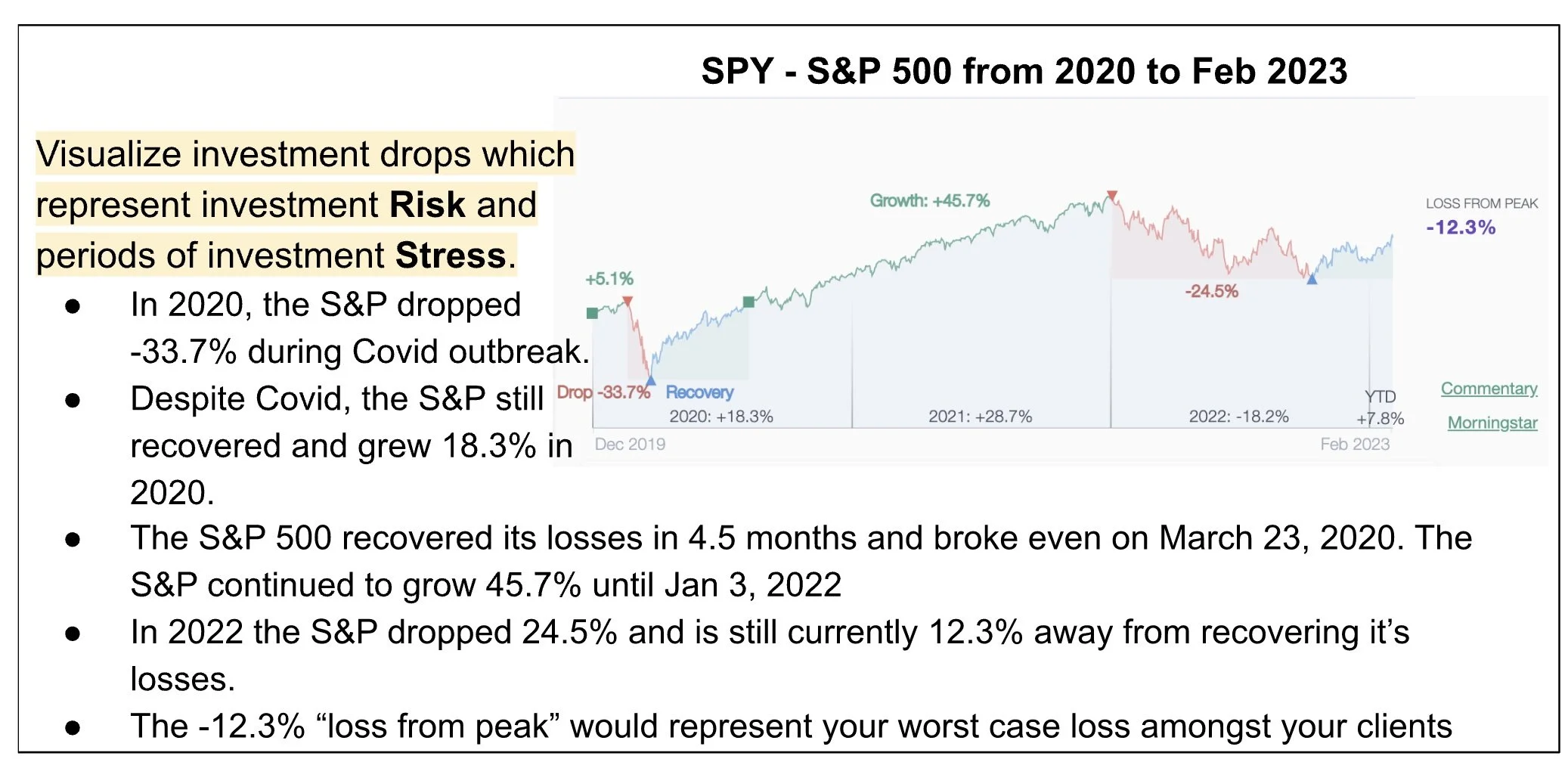

Visualize investment risk and stress

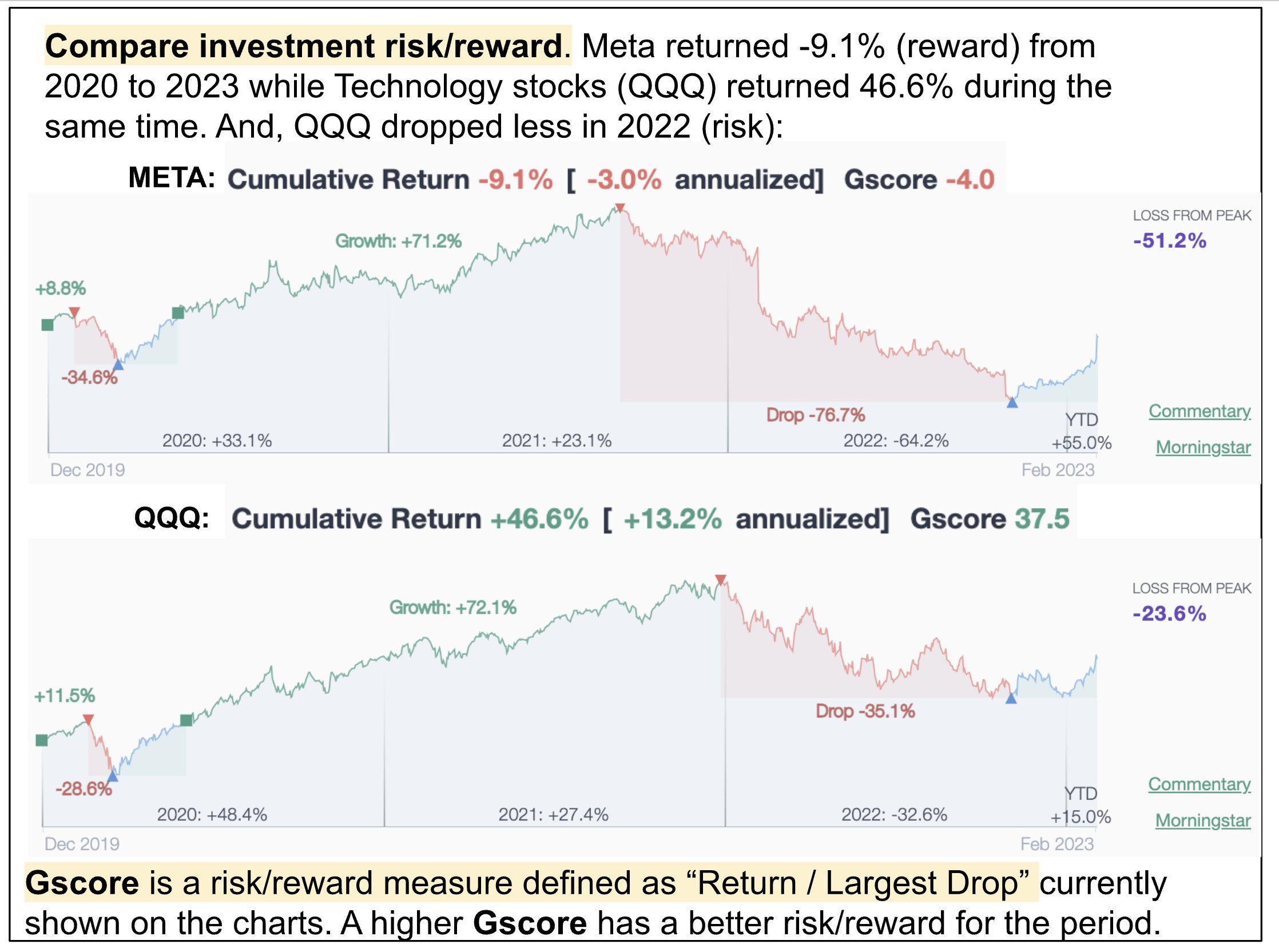

Compare investment risk/reward

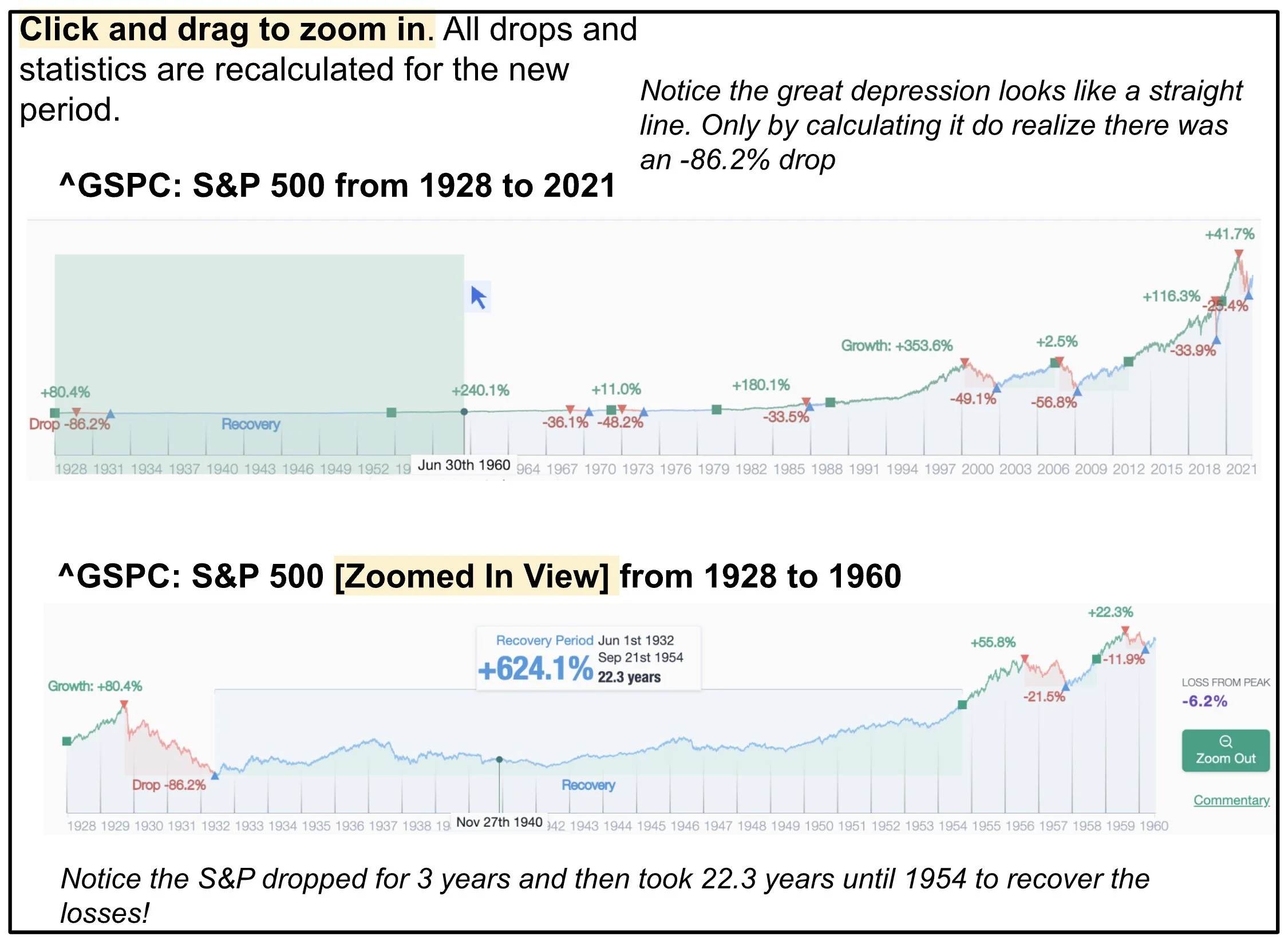

Adjust viewing dimensions

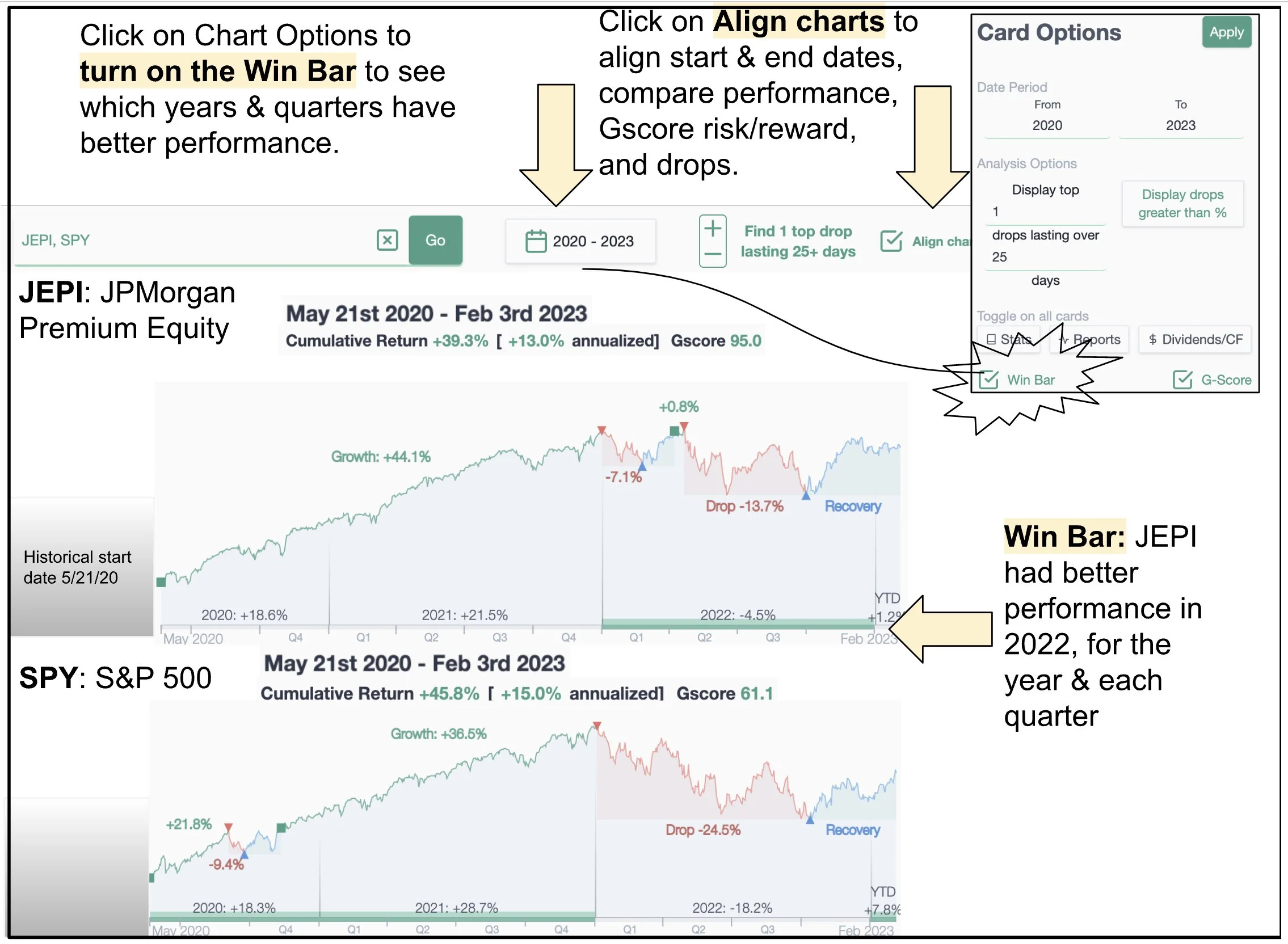

The Win Bar

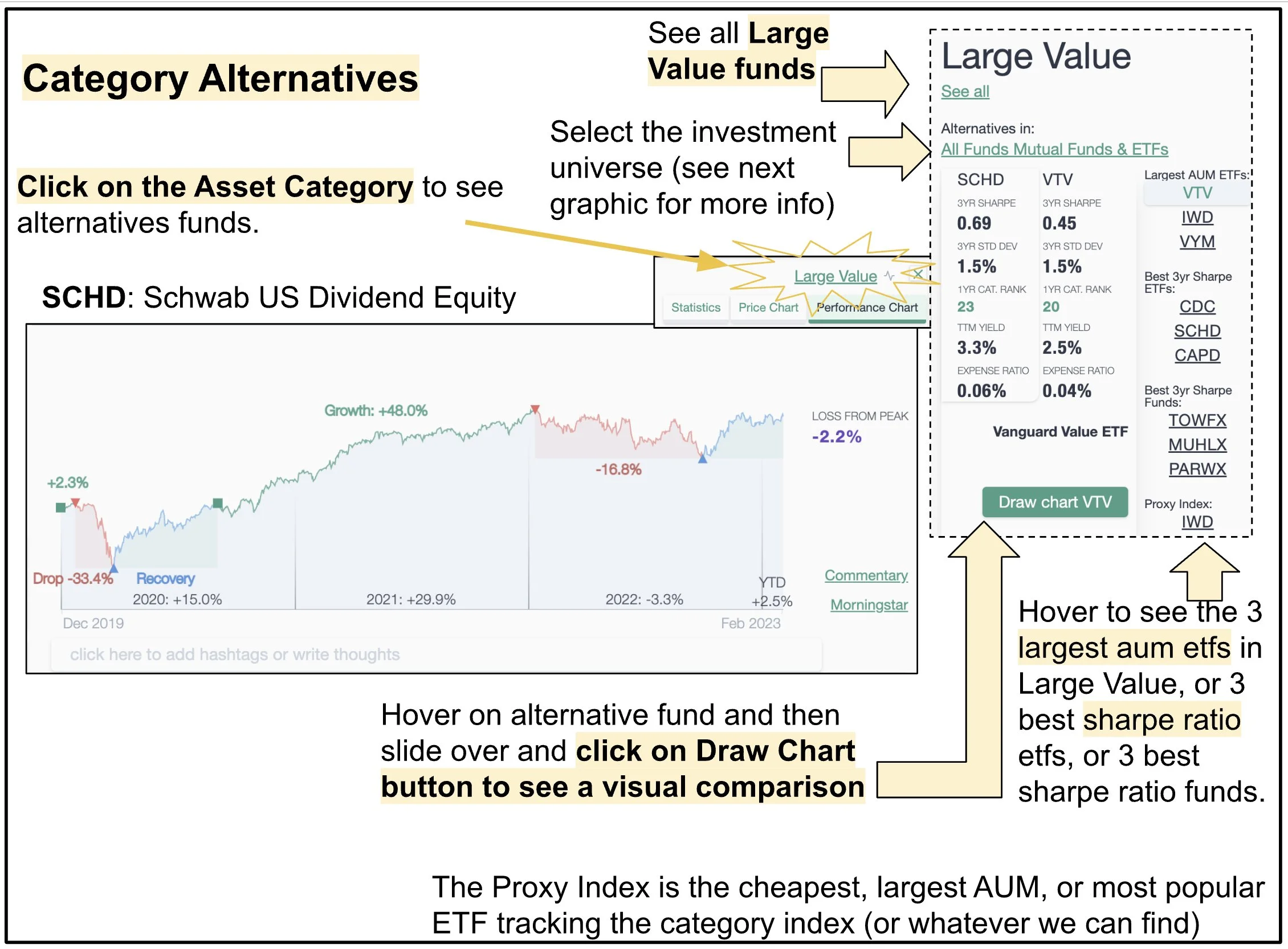

Search for Category Alternatives

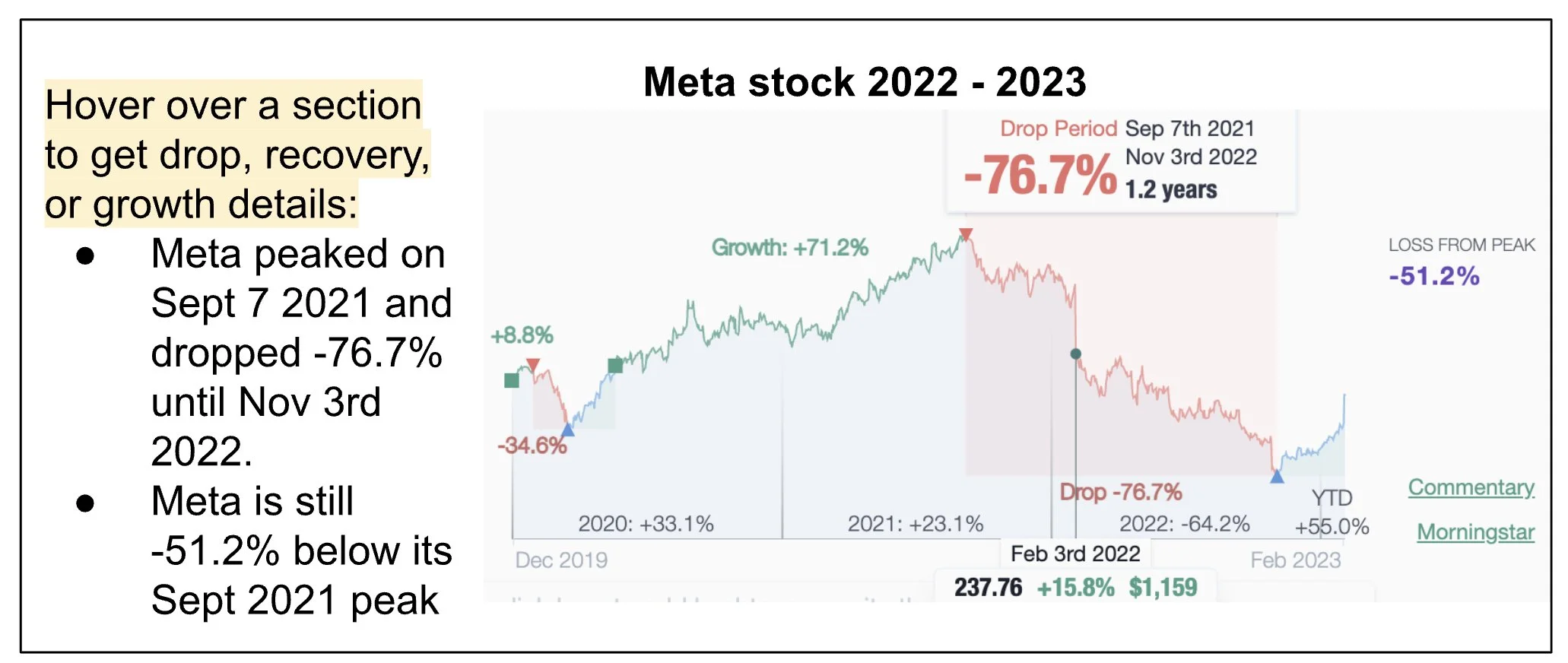

Analyze your investment’s drops and recovery periods

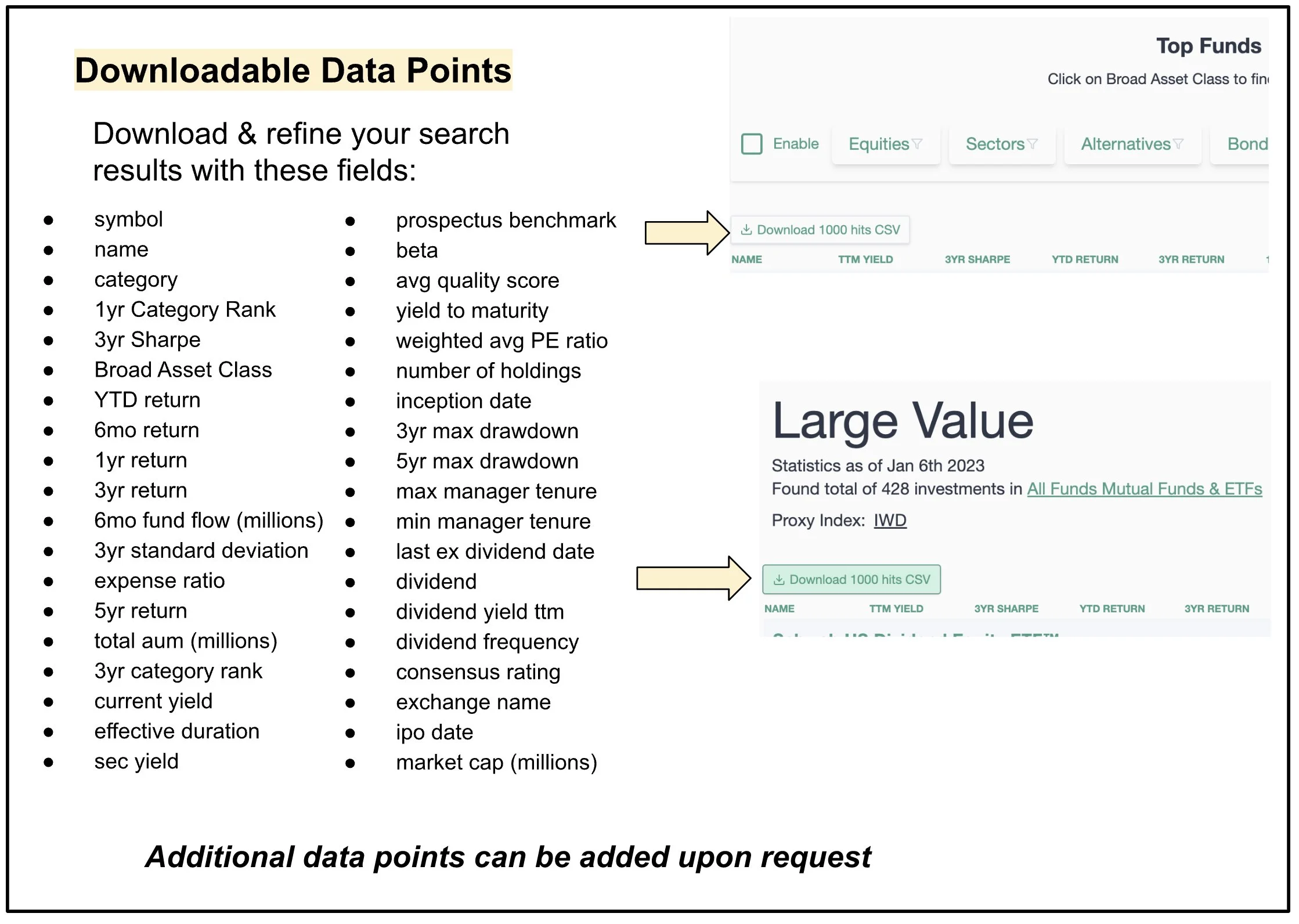

Downloadable Data Points

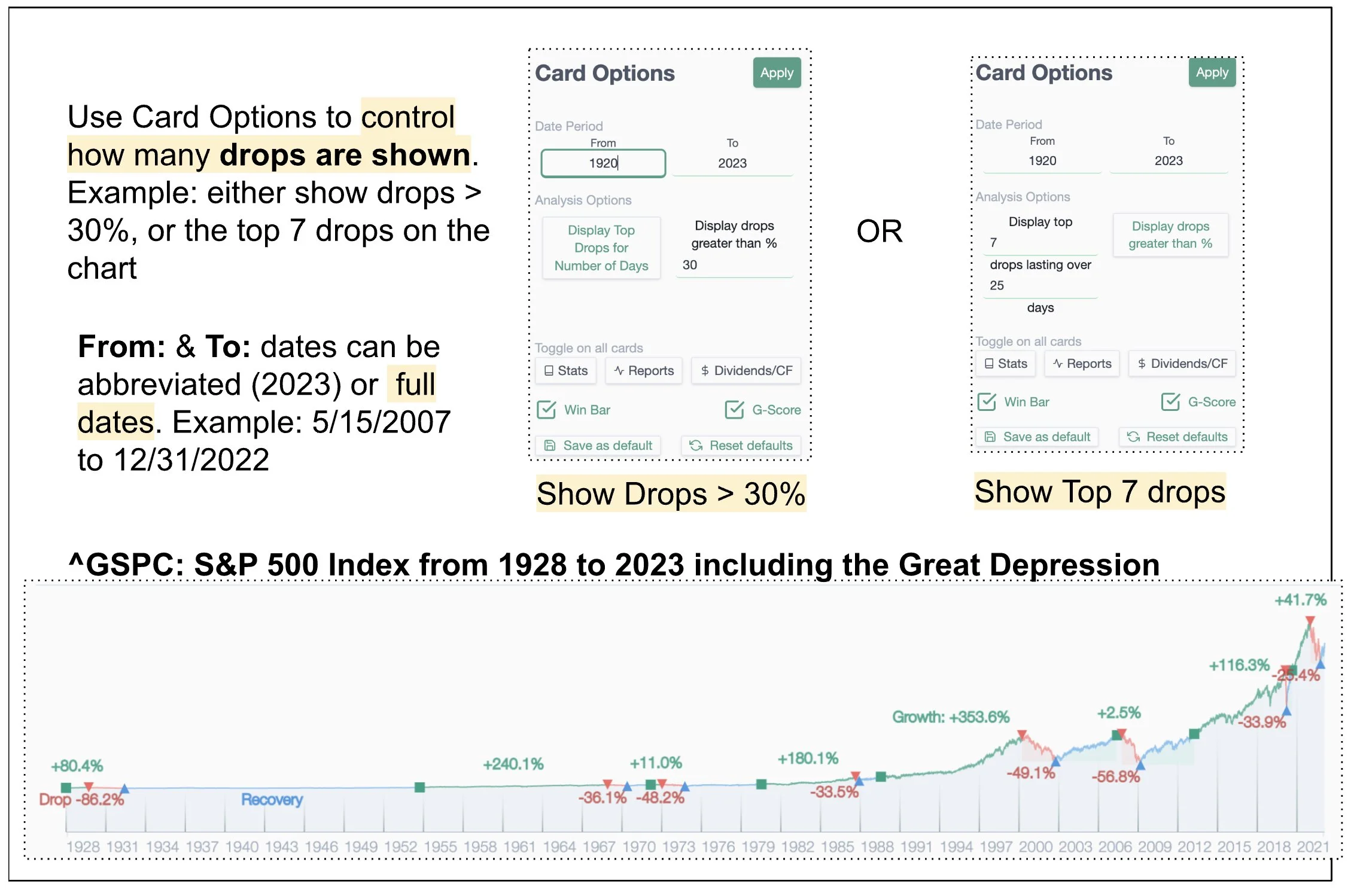

Adjust how many drops over a specific timeframe are shown

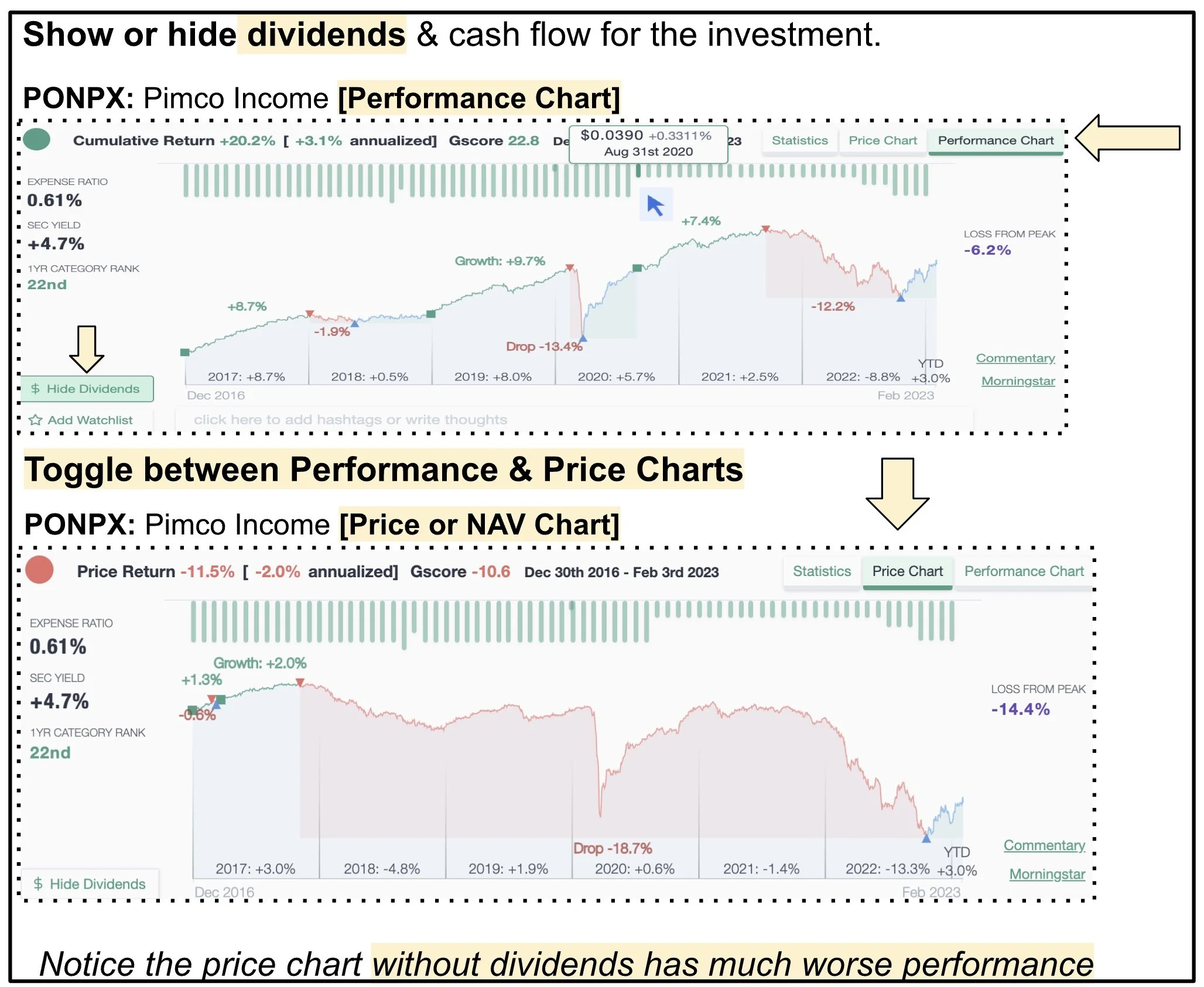

Ability to display dividends, performance, and price charts

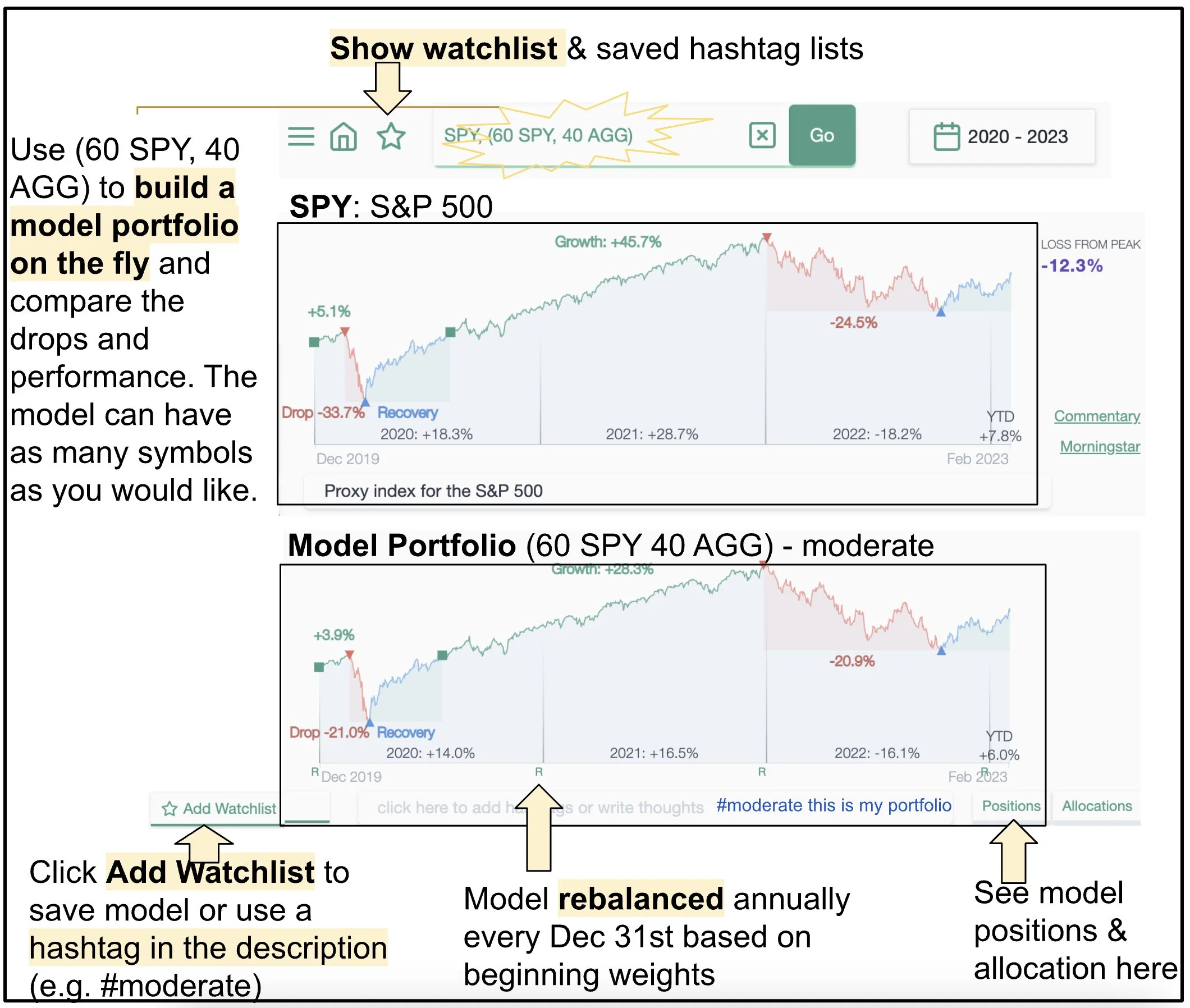

Want to keep up with a stock? Add it to your watchlist

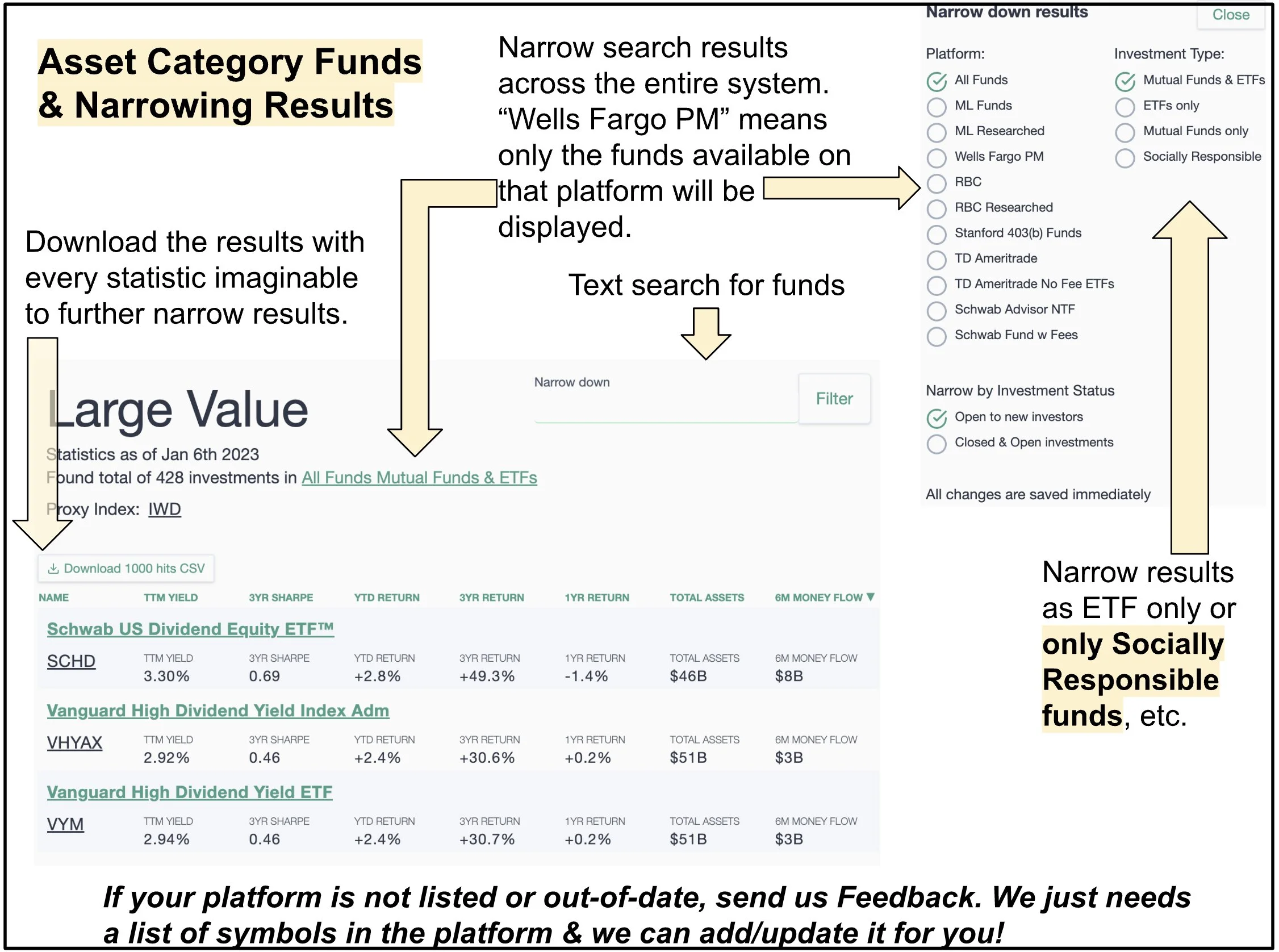

Asset Category Funds & Narrowing Results

Search for specific funds

Fair Advisor Pro is designed for financial advisors at wire houses, broker dealers, and registered investment advisor firms. It includes all of the capabilities of Fair Insight plus:

The ability to import the holdings from your book of business

The ability to import a client prospect’s existing portfolio, including cost basis, unrealized and realized gains and losses, holdings, and transactions. Fair Advisor Pro will then compare the prospect’s portfolio to a benchmark portfolio and the advisor model portfolio

Continuous monitoring of the advisor’s entire book of business, including a holdings evaluation analysis ranking the holdings as red, yellow, or green

Mock trading of a client’s account based on advisor preferences and generated alerts (tax loss harvesting, 1yr or 3yr underperformance compared to the index, opportunist reduction of concentrated positions, etc.)

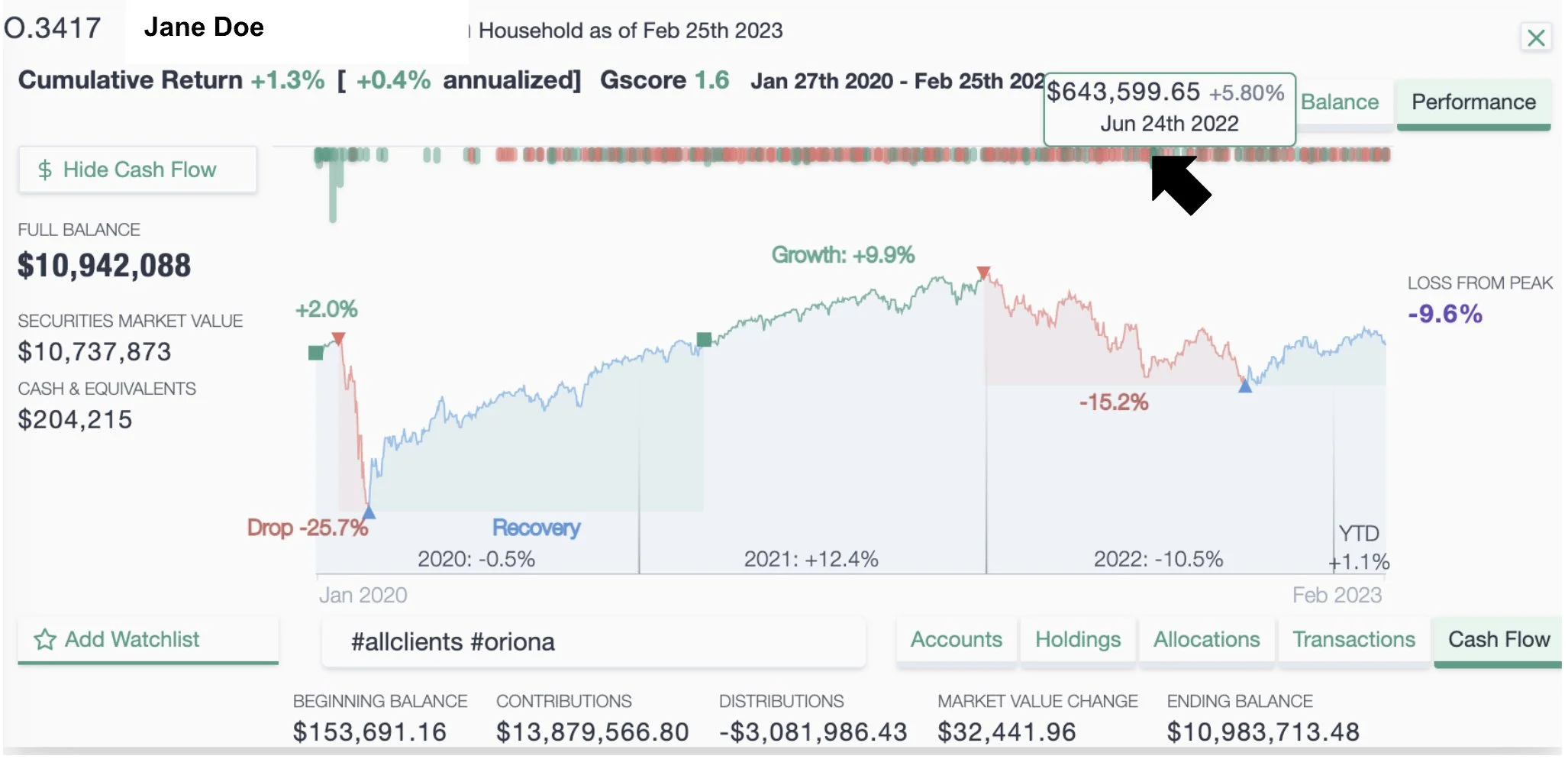

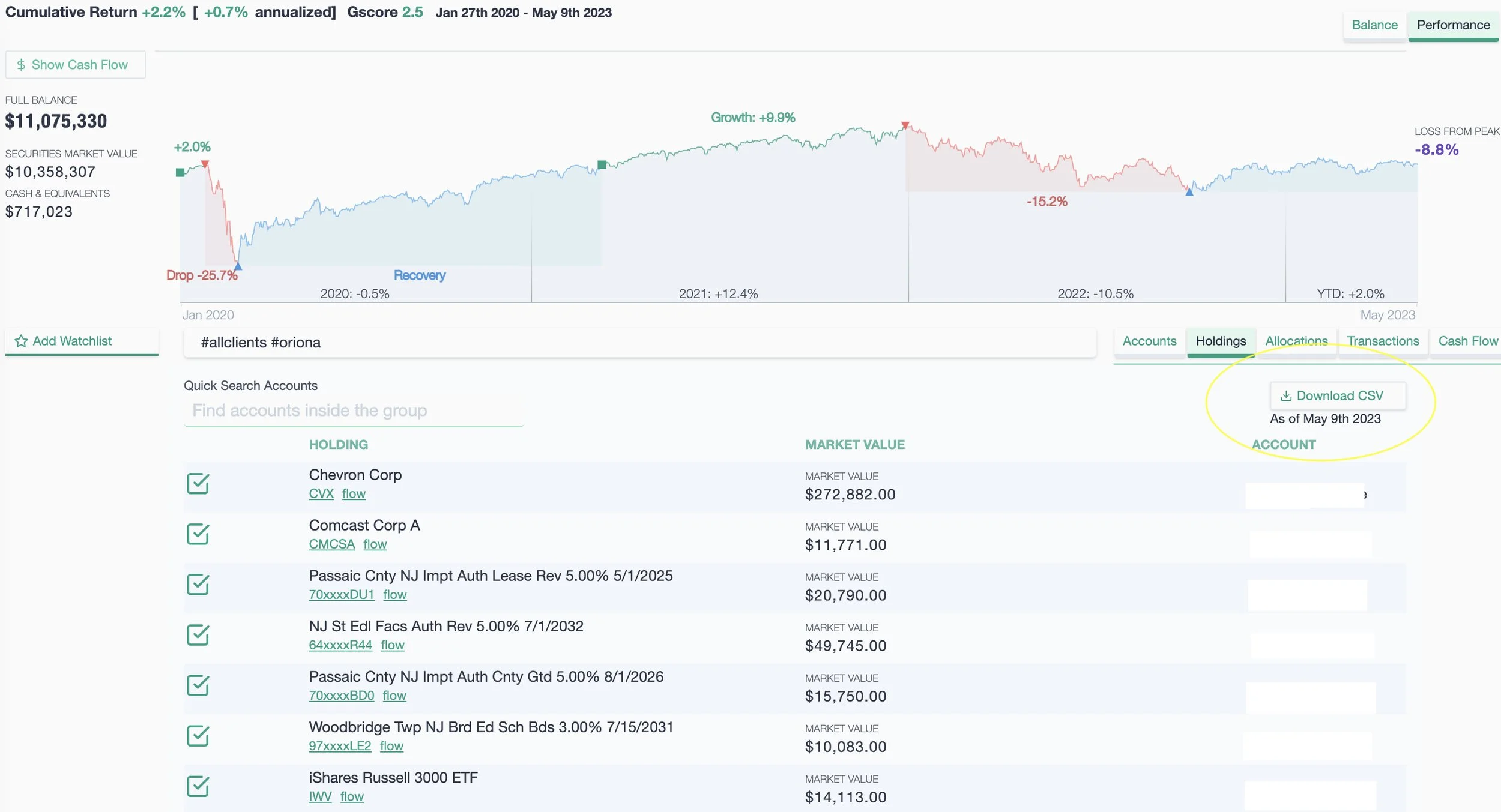

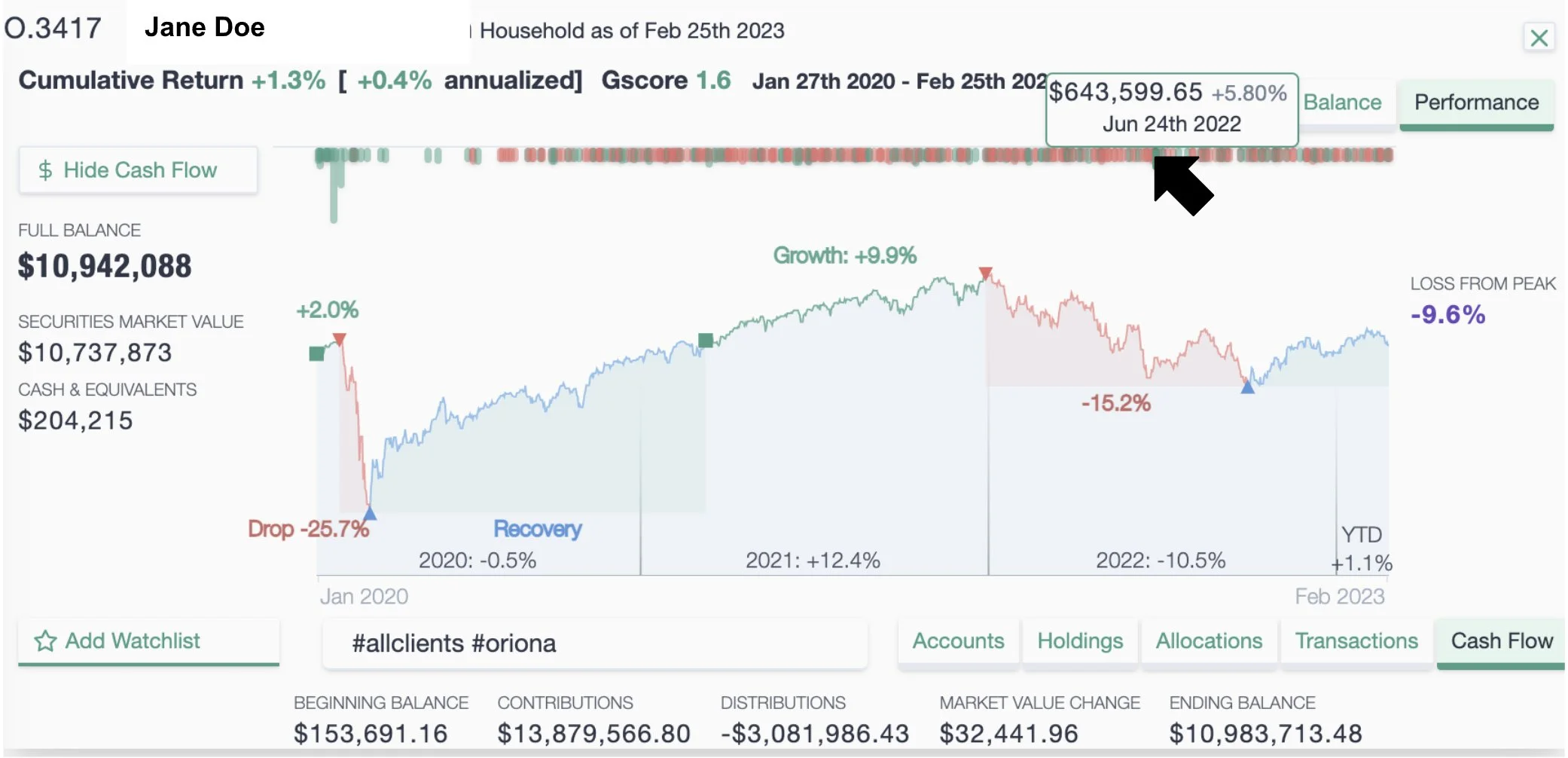

Based on the imported data, determine the client or prospect’s visual risk score, visual risk/reward quality, and the historical performance. Drill down into Accounts, Holdings, Allocations, Transactions, and Cash Flow. Compare portfolio alternatives. Mock trade portfolios and determine tax consequences.

Click on the Holdings tab and then “Download CSV” to see every statistic known for the client or prospect’s holdings. The platform will also evaluate the holdings as red, yellow, or green based on the advisors preferences. If a holding is marked red, the CSV file will mock sell the position in the “Trade” column (-1000 means sell $1000 worth of the holding) along with the share quantity and realized gain/loss information.

The holdings evaluation criteria (red, yellow, green) currently includes the following based on the advisors preferences:

Book & Holdings Analysis

3 Year performance lag vs index

1 Year performance lag vs index

Tax Loss Harvesting opportunity

Concentrated Position

Peer Performance [performance]

Short Term Performance Reversal [performance]

Higher Downside Capture [increased risk during periods of stress]

Lower Diversification [fitness & correlation]

Higher Fee Underperformance [unjustified high cost]

Higher Tax Exposure [larger taxable events]

Hidden Risk [higher tail risk]

Exposure Outliers [exposure inconsistent with category]

Recent Outflows [drift & liquidity impact]

12b-1 fees and/or fund loads fees

Fair Advisor Realtime includes all of the features of Fair Advisor Pro plus a real time integration into your performance management system. Your book of business is updated multiple times a day, including holdings, transactions, cost basis, and allocations..

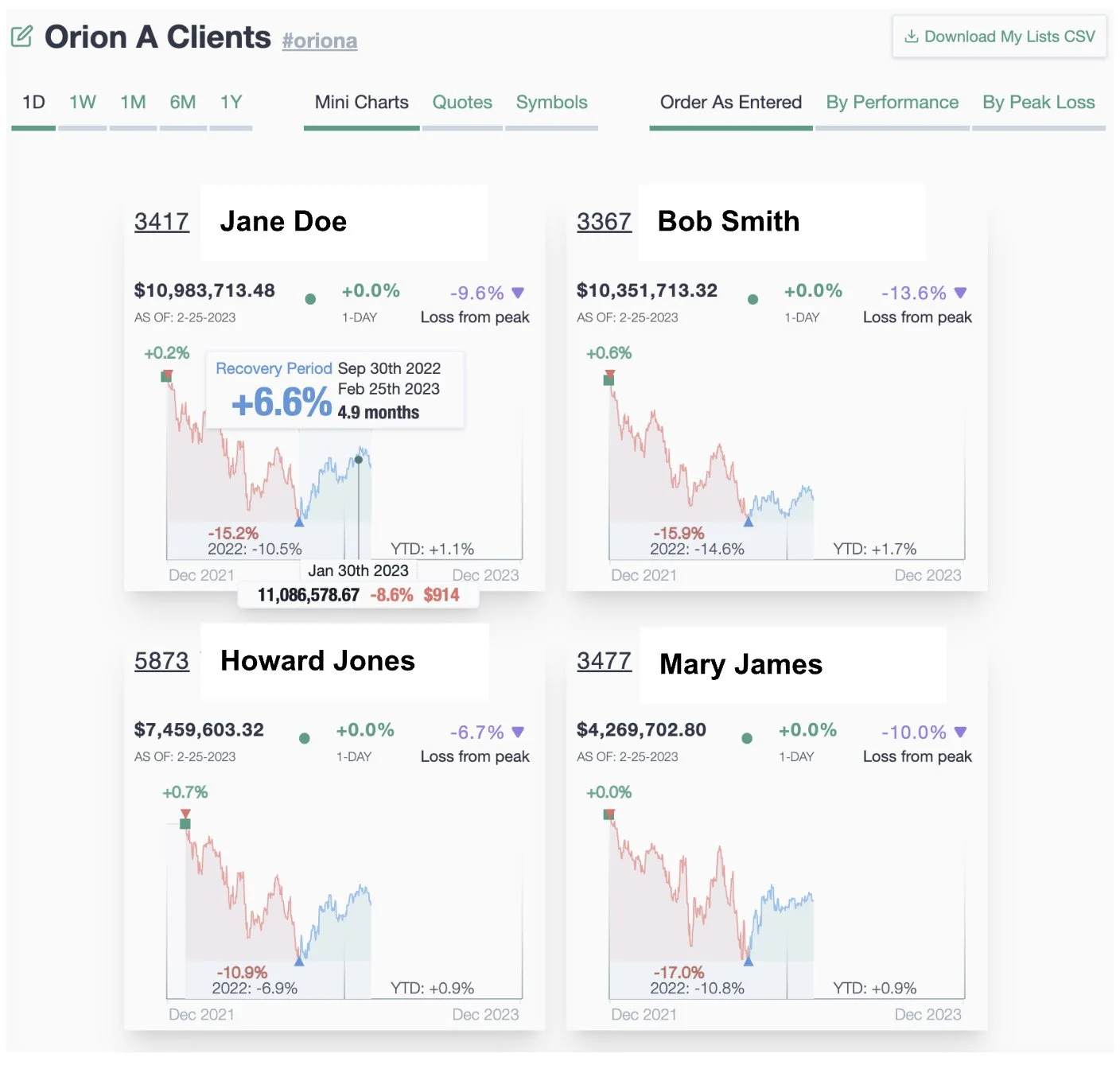

See all of your clients visually in an instant snap!

Each household, account, and asset is treated like a unique symbol in the system.

Click and drag to zoom in & see details. Click on the cash flow to see the transactions on that day

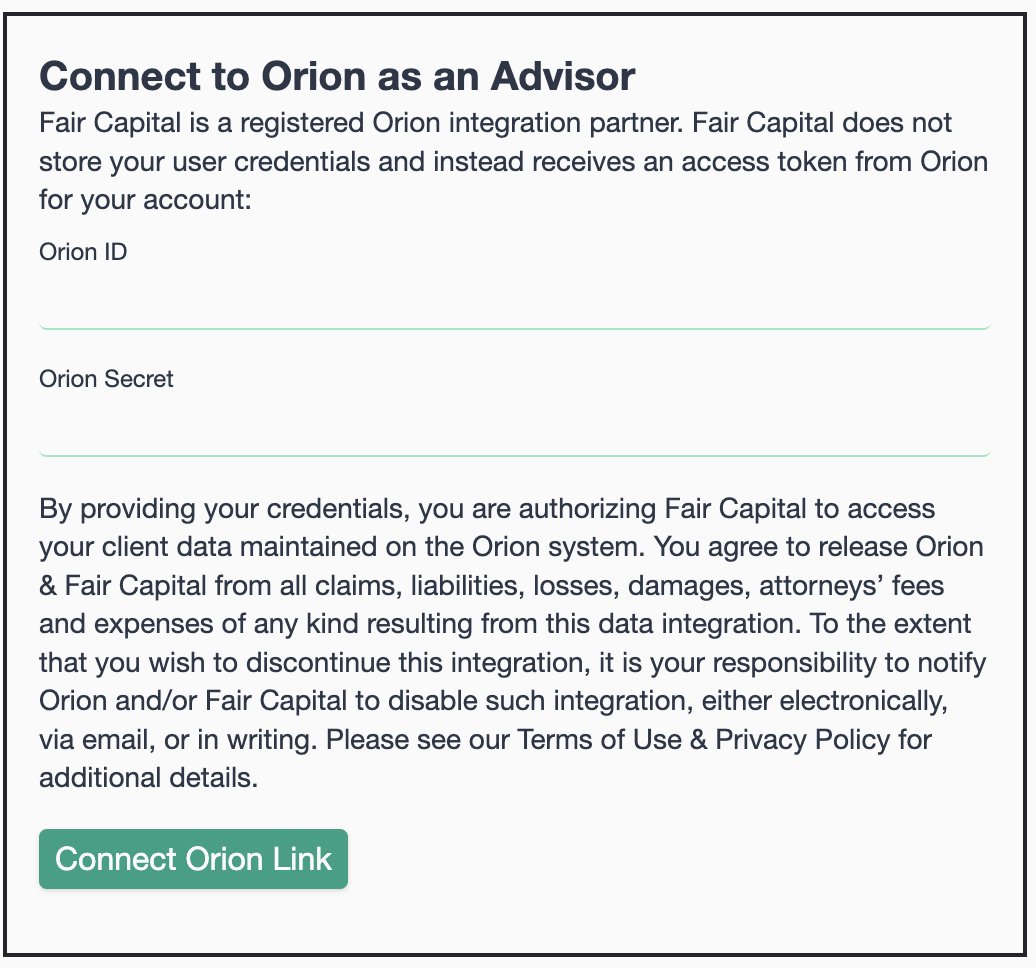

Any user of Orion can provide their user credentials to connect to their book of business:

Assume the client portfolio is invested in stocks, ETFs, and mutual funds:

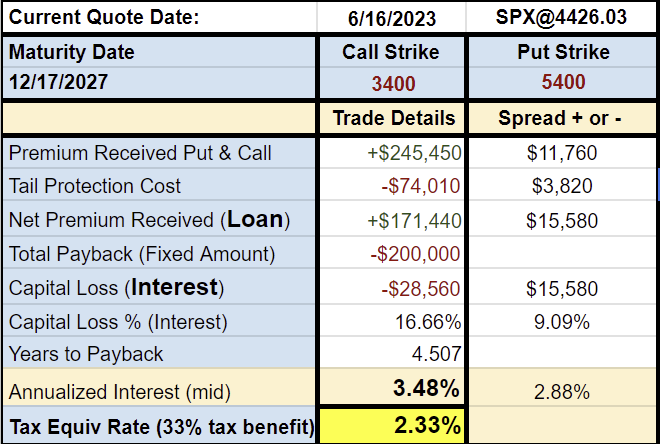

Sample Execution

Options

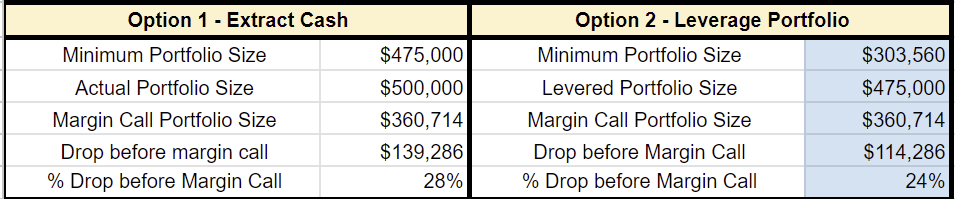

Option 1: Extract Cash

Minimum portfolio size: Total payback multiplied by 2, plus $75,000 (15% of current SPX value)

Actual portfolio size: $500,000

Margin Call Portfolio Size: Total payback divided by 70% plus $75,000 (15% of current SPX value)

Drop before margin call: Actual portfolio size minus margin call portfolio size

% drop before margin call: Drop before margin call divided by actual portfolio size

Option 2: Leverage Cash

Minimum portfolio size: Principal amount borrowed plus capital loss (accrued interest) plus $75,000 (15% of current SPX value)

Levered Portfolio Size: Minimum portfolio size plus net premium received (loan)

Margin Call Portfolio Size: Total payback divided by 70% plus $75,000 (15% of current SPX value)

Drop before margin call: Levered portfolio size minus margin call portfolio size

% drop before margin call: Drop before margin call divided by actual portfolio size

Sample of Options